Premier's reform focus demands appreciation

By Zhao Yinan (China Daily) Updated: 2014-11-08 08:35

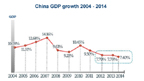

Premier Li Keqiang has rarely passed a strong remark or taken an aggressive step to boost the economy despite the first slowdown in economic growth in more than a quarter of a century, and this is exactly the type of prudence the market needs now. Amid mounting expectations of broader policy easing, such as cuts in the interest rate and bank reserve requirement, the premier has pushed for deeper economic reforms, instead of a large stimulus.

Li and his colleagues have vowed to make investment in China easier by reducing red tape and widening access to restricted sectors, for both domestic and overseas capital. The weekly meeting of the State Council, China's Cabinet, on Nov 5 focused on reforms and pledged to revise some laws to do away with the precondition for government approval for investment, unless they were absolutely necessary.

This is the most radical step the premier has taken to reduce government intervention in the investment market and also a major step in creating an open market after the country's top economic planning body proposed on Nov 4 to significantly slash the number of sectors off limits to foreign investors. Such changes, in line with the reforms Li has been painstakingly pushing for during his 20 months in office, are expected to make it easier for investors to do business in China in the long run.

However, this may not be able to satisfy the rising demand for more liquidity in the market. It may not prove very helpful to current economic growth, either, which some analysts say could slump to 6.7 percent or even lower next year.

Nevertheless, this is not the first time that the government has refrained from issuing broad pro-growth policies and promoted slower, but healthier, reformative measures to correct the deep-rooted structural problems, nor will it be the last.

China's reform-minded leadership has not changed its stance. At least, it still doesn't see any immediate need for it.

But it would be strange, if not wrong, for the market to equate the cutting of interest rates with strong stimulus. The simple and effective monetary policy, as long as it is used properly, will not lead to mounting debt and a bigger property bubble. It is usually the market, which tends to read too much into such policy changes, that sets off wrong alarms and takes wrong steps. And it is often local governments and State-owned companies, which for long have been waiting for a hint of policy change, that take advantage of the chances offered by the policies despite the risks.

The national leadership has exercised impressive restraint in intervening in the market, a trait evident not only in Western market economy, but also in ancient Chinese concept of governance. Refraining to stimulate the economy should be appreciated at a time when the country is recovering from the hangover of the 4-trillion-yuan ($650 billion) package in 2008 and trying to uproot the deep-seated economic problems.

The author is a senior reporter of China Daily. zhaoyinan@chinadaily.com.cn

(China Daily 11/08/2014 page4)