Staying the course on structural reforms

By Axel Van Trotsenburg (China Daily) Updated: 2014-12-11 07:35In the short term, for example, the government has the option of focusing on strengthening market discipline in the financial sector. It could implement policies to facilitate the reallocation of resources from less productive sectors, including State-owned enterprises, to those with high growth potential. This would mean that China can deleverage while maintaining growth by using credit better. For example, the government could gradually remove implicit State guarantees and let market forces decide whether companies succeed or not. Doing so could generate efficiency gains for the economy.

In the medium term, China's primary challenge is carrying out reforms that will transform the economy into a more efficient one. That depends on the success of structural reforms in land, labor and capital markets. Good progress is already being made but more needs to be done.

For example, to integrate migrant workers more fully into urban life, the government has announced plans of gradual adjustments in the hukou (household registration) system, which would lead to more efficient use of labor. It has also introduced a comprehensive reform plan to improve China's public finances, which would remove the incentives for wasteful real estate development and inefficient urban sprawl.

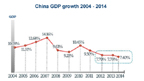

These transformational reforms, which call for a carefully coordinated approach, will move China in the right direction and lay the foundation for higher economic growth in the long run. But they will not reverse a trend of moderating growth over the next decade. The extent of moderating growth will therefore in large part be determined by the government's ability to implement the necessary policy actions.

As the global economy continues to struggle, especially the economies of Japan and European Union, the world relies on China's growth engine more than ever - in 2013 it accounted for 30 percent of global growth (37 percent at purchasing power parity) compared with 22 percent of the United States (10 percent at PPP) and less than 1 percent for the EU (PPP). While the moderation of growth in China may somewhat soften global demand, it will enhance prospects of the world's second-largest economy transitioning to a more sustainable and efficient growth path.

The author is World Bank vice - president for East Asia and Pacific.