Economy will prove naysayers wrong

By Bruno Deschamps (China Daily) Updated: 2014-12-17 07:34As the end of the year approaches, it has become increasingly clear that 2014 will be a year marked by moderate economic growth and low inflation for China. Analysts and investors have already shifted their attention toward the year ahead and beyond. They have been following economic news and paid close attention to the policy announcements made during the Central Economic Work Conference, which ended on Dec 11.

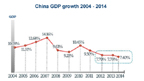

Recent economic data has been underwhelming. Between the slowing of exports (4.7 percent growth in November), the stalling factory output (7.2 percent growth in November), and the cooling property market, most indicators point toward a slowdown in the Chinese economy. GDP growth fell to 7.3 percent in the third quarter, and a majority of analysts have forecast that growth will slow to about 7 percent in 2015.

These forecasts are generally consistent with the statements made during the CEWC, where China's leaders, including President Xi Jinping, said the economy faces "big downward pressures". They also said they would accept a lower and more sustainable growth rate in the years ahead, which they refer to as the "new normal". No official growth target has yet been announced, but central bank economists, in their personal capacity, have said real GDP growth is likely to slow down from 7.4 percent this year to 7.1 percent in 2015. Many other observers expect that it will be set at 7 percent.

In spite of these moderate forecasts, the current slowdown has reignited the debate over the medium-term prospects for the Chinese economy. Although most analysts remain confident, some commentators have argued that the country is slipping into the dreaded middle-income trap, perhaps even suggesting an end to China's economic miracle. These fears are however largely overblown. At this stage, the scenario of a moderate slowdown for next year and beyond, which is preferred by a majority of analysts, should be favored over the prediction of a sharp slowdown.

Experience shows that some economic commentators tend to overreact to weak economic data. They place too much weight on latest economic indicators and sometimes miss the bigger picture. During 2008-09, for instance, the global recession led some to quickly forecast a sharp decline in China's growth. But that did not happen, in part because they had failed to anticipate the strong policy response and the efficacy of the stimulus package.