Many in West back winds of change in world

By Martin Khor (China Daily) Updated: 2015-04-23 07:52

It is thus imperative that the new banks take on board high social, environmental and fiduciary standards, besides having good internal governance and being financially viable. The new banks should be as good as or better than the existing ones, which have been criticized for their governance, performance and effects.

There is no certainty that the new banks will succeed. But they should be given every chance to do so.

The significance of the AIIB is being seen as part of the jostling between the US and China for influence in Asia. A few years ago, the US announced a "pivot" or re-balancing to Asia, which included enhanced military presence and new trade agreements especially the Trans-Pacific Partnership Agreement.

It seemed suspiciously like a policy of containment, or partial containment, of China. The US combines cooperation with competition and containment in its China policy, and it retains the flexibility of bringing into play any or all of these components.

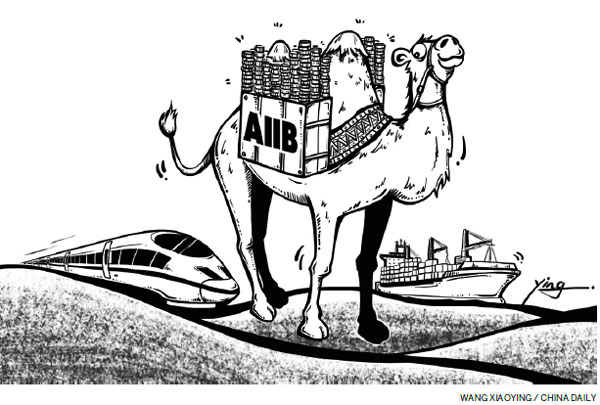

China now announced its own initiatives-the Silk Road Economic Belt and the 21st Century Maritime Silk Road. The first will involve infrastructure projects, trade and public-private partnerships, and details of the second are being worked out. The AIIB can be seen as a financial arm (though not the only one) of these initiatives.

Now, prominent Western opinion makers are urging the US to change its policy and to accommodate China and other developing countries. The winds of change are blowing in the global economy, and many in the West recognize and even support this.

The author is executive director of South Centre, a think tank of developing countries, based in Geneva.

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.