Upcoming meetings chance to build fire wall against Brexit

By Fu Jing (China Daily) Updated: 2016-07-05 07:45

|

|

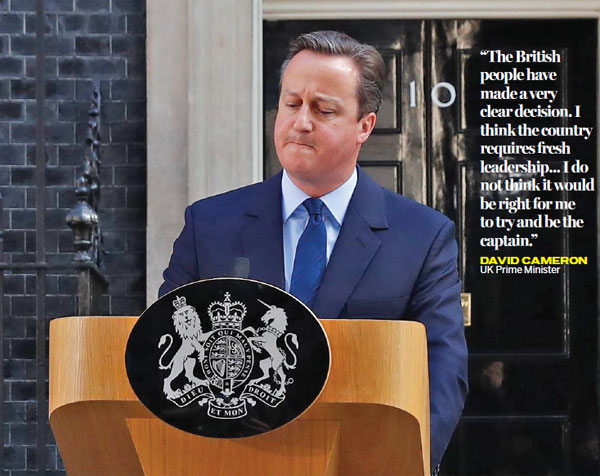

Britain's Prime Minister David Cameron speaks outside No 10 Downing Street in London on June 24 after Britain voted to leave the European Union. Stefan Wermuth / Reuters |

In a few days, Beijing and Brussels will hold their annual summit, which will be an occasion for European Union leaders to discuss the breathtaking drama of Brexit with China.

There will also be an opportunity for the EU to outline the situation to its Western partners at the NATO gathering in Warsaw this week.

There will be other occasions, too. In addition to Beijing-Brussels meeting, the leaders of Asia and Europe may put European leaders and the outgoing UK Prime Minister David Cameron through the mill at the upcoming Asia-Europe Meeting in Ulaanbaatar, Mongolia on July 15 and 16.

And when the G20 leaders meet in Hangzhou of East China's Zhejiang province in early September, the uncertainties and risks triggered by the United Kingdom's unexpected vote to leave the EUin its referendum on June 23, and the evolving consequences of that decision, are certain to be added to the agenda.

However, all these economic and political summits will be held before Cameron's successor as prime minister takes office.

And Cameron has stated it is up to UK's next leader to officially notify the EU of the UK's intention to leave and start the departure process by evoking Article 50 of the Lisbon Treaty.

Thus the curtain has just begun to be raised on the drama. If what has happened during last 10 days in the UK's political arena and global markets is an example, it is certain that more risks, uncertainties, market twists and widespread pessimism will occur.

And if the situation is not well-managed and trust- and confidence-building messages are not delivered in a timely fashion, the consequences of this black swan event will be even more unpredictable.

It is thus imperative that the consequences of Brexit are fully discussed at these forthcoming meetings. It is also essential that information sharing, confidence-building and risks prevention are strengthened, because the repercussions of the UK's prolonged divorce proceedings from the EUare sure to be felt around the world if a firewall is not in place.

Thus, in particular, Brexit should be high on the G20 agenda.

When the global financial crisis began to unfold in 2008 and 2009, the leaders of the advanced and emerging economies sat down and ushered in the G20, which proved quite successful in addressing the crisis and coordinating the global response.

Brexit runs counter to the trends of globalization and regionalization and the G20 leaders will once again need to show vision and take concerted actions to address the risks and uncertainties it will cause.

Simply put, in a tightly-connected global village, each county's troubles affect others to some degree.

When its debt crisis erupted during the global financial meltdown some predicted that the EU's economy would face a lost decade. That looks even more likely if the UK's divorce from the bloc is prolonged and messy.

In such a situation, one can see the EU struggling to hold on to its members and failing to gain the support of other countries, which would only exacerbate the crisis.

That scenario would lead to the EU losing its attraction for other strategic partners forming a dangerous spiral that could quickly spin out of control.

So it is extremely important the EU leaders use the upcoming platforms to comprehensively discuss the situation with its partners and build a pragmatic consensus on the way forward.

Importantly, though the markets have been stormy in previous days, the central banks of the world have said that they are coordinating their stances and actions.

This is a welcome start, but more concerted actions will be needed to ensure the fallout from Brexit is contained.

The author is deputy chief for China Daily European Bureau. fujing@chinadaily.com.cn

- Johnson says UK government needs to spell out Brexit benefits

- Brexit offers opportunity to country's auto sector, buyers

- Thousands march against Brexit in London

- Brexit effect eases, rebound likely

- May: UK needs clear stance on Brexit

- Brexit will have far-reaching consequences

- Brexit may boost RMB internationalization

- China-UK ties to remain strong despite Brexit, envoy says