|

|

|

|

|||||||||||

A free trade agreement between China and South Korea will probably precede a planned China-Japan-South Korea FTA, a senior official from the Korea Trade-Investment Promotion Agency said.

The FTA is likely to be concluded first "because research for the bilateral FTA is advanced and the Chinese government has taken an active interest", Park Jin-hyung, KOTRA's executive vice-president for China, told China Daily.

Wang Luo, a researcher from the Chinese Academy of International Trade and Economic Cooperation, a Ministry of Commerce think tank, said: "China and (South Korea) took a very clear position for the bilateral trade agreement and preparations are ongoing.

"The trilateral trade agreement may be launched during a tripartite summit in May, but that is subject to change".

Park said the three countries will probably release a final report on the joint research for the trilateral FTA during the summit.

China, Japan and South Korea signed a trilateral agreement to promote investment on March 22, after five years of negotiations, according to China's Ministry of Commerce.

Jiang Jiqing, director of the Department of International Trade and Economic Affairs at the ministry, said that the investment agreement "will pave the way" for an FTA between China and South Korea, as well as the trilateral pact.

Park said that "the investment deal will serve as the bridge for the trilateral FTA".

The trilateral FTA, "although it will challenge (South Korea's) primary industries of agriculture, animal husbandry and seafood, will have an active influence on (South Korea) on the whole and is welcome at home," said Park.

He suggested the manufacturing industry would be an easy start for the trilateral FTA negotiations and urged China to further open its services sector.

He added that a trilateral FTA would enlarge the regional trade volume and offset sluggish demand from the European Union and the United States.

Investments from Chinese companies will keep growing in South Korea, especially in manufacturing and high technology, since joint ventures melding Chinese capital and South Korea's advanced technology will have a competitive edge in the EU and US, according to Park.

For example, China's AVIC International Energy signed a cooperation agreement with Modn M-Tech on March 19.

The deal involves investment of $30 million to set up a factory in South Korea to make electric vehicle battery equipment.

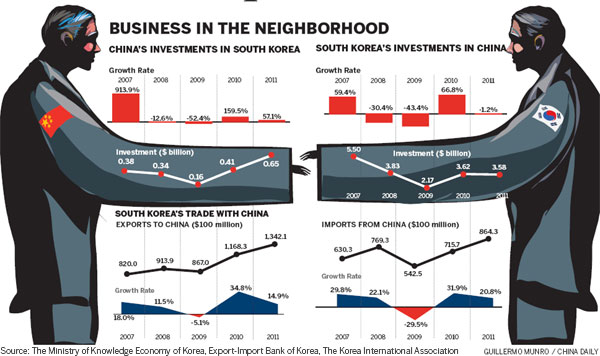

South Korean's cumulative investment in China reached $36 billion as of 2011, Park said (though China gives the figure as $50 billion), while China's investments in South Korea - mainly in tourism and entertainment - only reached $3 billion.

The discrepancy implies that Chinese companies did not find suitable investment targets in South Korea, Park said.

More than 50 percent of the South Korean companies investing in China aimed to explore the domestic market, according to a survey by KOTRA in 2010.

The percentage was about 30 percent from 2007 to 2009.

"South Korean investors generally hold that it's no easy thing to explore the huge market in China without investment in production facilities or setting up companies in China.

"Communications, vehicles and machinery are the most common areas for South Korean investment in China, but the service industries, wholesaling and retailing are increasingly favored," Park said.

Despite the promise of China's central and western areas, most South Korean investors have hesitated to go there, as they lack knowledge of local markets. The lack of staff, tougher environmental standards and regulatory changes also challenged South Korean investors in China.

Ding Qingfen contributed to this story.

lijiabao@chinadaily.com.cn