Mainland stocks increased amid choppy trading on Monday, reaching their highest level since June 2012.

The Shanghai Composite Index climbed 0.48 percent to 2328.22 points, with the index rising around 19 percent since Dec 3. The Shenzhen Component Index rose 1.38 percent, to close at 9562.85 points, reaching its highest point in almost eight months, while the Shenzhen B index climbed to 5474.4 points, its highest level since July 2011.

The increase was driven by a number of factors, including Friday's announcement by China Vanke Co Ltd, the country's largest property developer, that it plans to move its foreign currency-denominated B shares from Shenzhen to Hong Kong.

Vanke's stocks soared 10 percent on the news, the daily limit for mainland-listed stocks.

B shares performed well on Monday as investors expect more companies will soon transfer their listings to Hong Kong.

The Hang Seng China Enterprises Index of mainland companies traded in Hong Kong rose 0.23 percent, to close at 4721.71 points.

Other factors driving property-related stocks included a report that the Ministry of Land and Resources had approved a property development project in Shenzhen, pushing up real estate stocks by 0.82 percent.

China's 2012 GDP figures, which showed that economic growth picked up to 7.9 percent in the fourth quarter, were good news for the Chinese stock market, said Li Daxiao, head of research at Yingda Securities.

"The A-share market is at the start of a bull market, and this could possibly last for a long time," said Li.

huangtiantian@chinadaily.com.cn

Property sector leads stock market rally

Chinese brokerages bullish on stock market

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

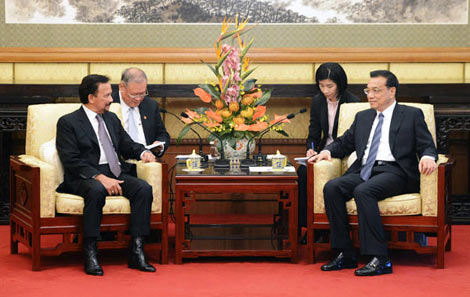

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show