Adapting to the 'new normal'

By Louis Kuijs (China Daily) Updated: 2014-12-13 09:00Central Economic Work Conference report indicates a search for balance between growth and reform amid difficulties

A document released by the country's leadership at the conclusion of this year's Central Economic Work Conference on Dec 11 sets out the main objectives and principles for the economic policy of 2015, with a large part devoted to describing the "new normal" for China's economy.

Nonetheless, the leadership has stated that "the key is to maintain a balance between steady growth and structural adjustment" and made striving to maintain steady economic growth as the top priority.

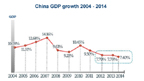

What is "steady" economic growth? While the GDP growth target for next year will be announced only in March 2015, earlier statements from senior leaders, including President Xi Jinping, suggest that the target for GDP growth will be lowered from 7.5 percent in 2014 to around 7 percent in 2015.

How does the leadership expect to meet this target? The official labels used to describe the stance on the monetary and fiscal policies remain unchanged. However, the government wants the "pro-active" fiscal policy to be "more forceful" and the "prudent" monetary policy to ensure "appropriate" monetary conditions. In other words, following the steps to ease macroeconomic policies to support growth in recent months, the leadership calls for some further easing of fiscal and monetary policy to boost growth.

On the fiscal front, I expect a mildly expansionary government budget next year, with a somewhat higher budget deficit than in 2014. The language on monetary policy means that, while the leadership wants to rein in the pace of increase in overall leverage and financial risks - indeed, the conference statement notes the need "to resolve the various risks associated with high leverage and bubbles" - it also wants the monetary policy to more directly support growth. As a result, I expect policymakers to combine tightening up regulations on shadow banking and containing the associated risks with cutting benchmark interest rates further and lowering reserve requirement ratios in 2015.