Adapting to the 'new normal'

By Louis Kuijs (China Daily) Updated: 2014-12-13 09:00The specifics of next year's fiscal and monetary policies will depend on economic development. What can we expect? The real estate sector's downturn is likely to continue to weigh on the economy. Corporate investment is likely to continue feeling the downward pressure from overcapacity and an uncertain demand outlook.

But other domestic growth drivers should do better. Urbanization will continue. Consumption growth should remain reasonable amid continued solid income growth in a labor market that is holding up even though the slowdown of migrant employment growth shows that the labor market is not immune to the economic slowdown. The lower prices of raw materials in global markets such as oil help support purchasing power of households and margins in manufacturing. They will also keep inflation subdued.

Also, infrastructure investment momentum should remain solid in 2015, as it continues to be a preferred way to support growth. Export growth is likely to be reasonable but unimpressive next year given the outlook for global demand.

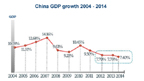

So we expect about 7 percent GDP growth in 2015, although the key risks around this outlook are weaker global demand, more pronounced gyrations of major currencies and a stronger downturn in real estate.

In the conference document the leadership has discussed several aspects of what it sees as the "new normal" for China's economy and what it calls for in terms of policy, touching upon the evolution of the composition of consumption and investment; upgrading the industrial structure, aging and decreasing surplus labor in agriculture and the need to rely more on the quality of human capital and productivity growth; improving the functioning of markets and allocation of resources; making growth greener and reducing carbon dioxide emissions; reducing financial risks; and solving overcapacity in "traditional industries".

The statement emphasizes that these trends and changes indicate that China's economy is moving toward a "new normal" stage, with a "more advanced and reasonable structure", slower growth, and larger contribution from productivity growth and human capital. Thus, the leadership is both observing underlying trends as China's economic development is entering a new phase and calling on policymakers to lead and stimulate those trends.

In this context, I would expect the reform process to continue in 2015, with progress particularly good in reforms that are politically easy and/or good for growth such as financial reforms and reducing red tape. I expect less rapid progress on politically thorny reforms such as reconfiguring intergovernmental fiscal relations and leveling the playing field for State-owned enterprises and other companies.

The author is chief economist in China at the Royal Bank of Scotland.