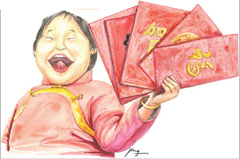

"If you hand out cash incentives, you really want to see who gets them and how much they get. It satisfies people's curiosity," Hong said.

It is convenient to give and claim the money. Senders and receivers have to bundle their debit cards with WeChat accounts, a prerequisite for promoting Tenpay, the payment arm of WeChat's developer Tencent Holdings.

Shen Ziying, a banker in Shanghai who has received three electronic "red envelopes", said, "While people may feel reluctant to sign up to spend money on a chat app, it's safe to assume that more are willing to receive money from friends."

WeChat's "red envelopes" have helped to increase Tenpay's user numbers to challenge its long-term archrival Alipay.

However, it was Alipay's parent, e-commerce giant Alibaba Group Holding, that invented the concept of the "red envelope" service on its Laiwang mobile messaging app late last year.

But the service was not popular, because of Laiwang's small user base. Laiwang had more than 10 million users as of October, compared with WeChat's 600 million.

Rivalry between the Internet duo heightened as both sought to create additional revenue streams.

Tencent recently launched a financial service product on WeChat, pitting itself against Alibaba's Yuebao personal finance product.

The two companies are also competing for passengers to use their taxi-hailing mobile apps, with both promising to waive 10 yuan for each journey, providing up to 10,000 free rides a day.

Yi Peng, head of the Pangoal Think Tank Information Consultancy in Beijing, said the two rivals are aiming to secure a foothold in the mobile Internet age.

According to the China Internet Network Information Center, the country had 618 million Internet users by the end of last year, with four out of five accessing the Net through mobile devices.

Yi said Tenpay's "torrid" growth, notably bolstered by the "red envelopes" move, is challenging Alipay's position in the third-party payment market, in which money is placed in special accounts for payment by intermediaries.

China's mobile third-party payments rose by 707 percent year-on-year in 2013, consultancy iResearch said. Alipay accounted for 75 percent of the country's mobile payment market as of June.

But Alibaba is struggling to gain increased market share in the mobile sector, Yi said.

Its Laiwang app is largely unknown and Sina Weibo, a popular micro-blogging platform in which Alibaba has a stake, is losing its appeal as users migrate to WeChat, he added.

|

|

|

| Where does the money go during the Spring Festival? | How to invest your year-end bonus? |

|

|

|

|

|

|

|

|