|

|

|

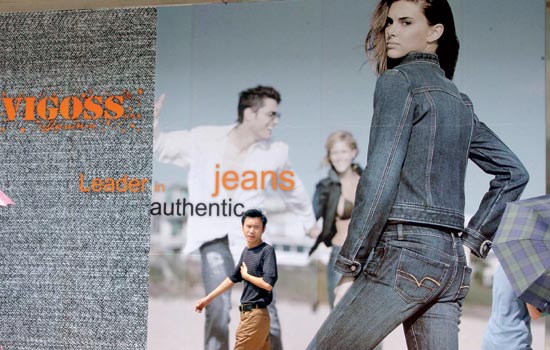

An advertisement for Vigoss jeans in Guangzhou, Guangdong province. The designed-in-China jeans sells at upscale stores such as Bloomingdales and Nordstrom in the United States. [Photo/China Daily] |

From the company's showroom, the 47-year-old entrepreneur could explain lines of cleaning robots like his own children.

Winbot, for example, is a recently developed window-cleaning gadget that sells for $399 and is beginning to get good feedback from the market.

Right now, although OEM still accounts for 70 percent of TEK's annual sales, sales of branded products already accounts for more than 50 percent of the company's profit, showing a visibly higher markup than the former.

In the first quarter of this year, TEK's overseas trade reached $354.6 million, showing growth of 27.1 percent year-on-year. By contrast, the city of Suzhou, faced with a general decline in orders for made-in-China goods, saw its trade value grow just 0.7 percent from the same period last year.

TEK has been diverting around 50 million yuan ($7.87 million), or more than 5 percent of its annual sales to R&D. But that doesn't lend much sense of security to Qian.

"In China, you get crushed if you don't innovate; but you may also get crushed if you do," he said.

Innovation requires taking a lot more risks than OEM, in that companies have to manage their own business strategies and cope with all market caprices. While OEM, especially in times of no change, tends to generate steady and timely returns.

More importantly, to focus on innovation, for an enterprise of 3,500 employees and sales of 100 million yuan ($15.7 million), also means resisting the temptation to just stay in the comfort zone or to chase speculative returns.

From the point of view of OEM, Qian admitted that TEK has "wasted a lot of opportunities", because it does not have the capacity to take all the orders coming its way.

Inevitably, TEK will take even fewer OEM orders. Qian said his plan is that original design manufacturing would account for more than 80 percent of TEK's business in three years, or that the company would be primarily operating based on its own patented technologies.

By then, TEK's game would be to learn to compete with the large international competitors with high finance and sophisticated technologies. But Qian said the company will continue to rely on its strengths in decision-making and innovation.

Managing relations

Wu Yixiong used to be one of the 3,000 factory owners who made a fortune making jeans in Xintang, a satellite town of Guangzhou dubbed China's "jeans capital".

But he did not want to be just one of the 3,000 factory owners who produce 60 percent of China's jeans and 40 percent of the world's, but do not own a single renowned brand name. He wanted to create his own brand.

Even among the few entrepreneurs who are seriously building their brands, Wu is unique. He leaves marketing and sales to local distributors while matching them with their most favorable designs.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions