|

|

|

Chinese wine buyers at the annual Vinexpo Asia-Pacific, the region's largest wine and spirits exhibition, in Hong Kong in May. The Chinese market for fine wines and liquor is growing fast in China. The better the quality and brand, the better the sales. [Photo / China Daily] |

Thanks to rising demand and per capita disposable income, China's consumption of alcoholic drinks is expected to reach 84.37 billion liters in 2016. That represents an average annual compound growth rate of 5.9 percent from 2012, said Frost & Sullivan, a US-based market consultancy.

Consumption of five major alcoholic drinks, including beer, white wine, rice wine, red wine and imported spirits, surged to 62.72 billion liters last year, compared with 46.52 billion liters in 2007, according to the consultancy.

Red wine is now the most popular alcoholic beverage with a penetration rate of 39 percent, far ahead of that of both white and fortified wines (2 percent). Red wine is closely followed by Chinese liquors (36 percent) and whisky (29 percent), according to a recent report by Ipsos, the Paris-based global market research company.

According to wine-info.com, China wine consumption expenditure reached 45 billion yuan ($7.1 billion) in 2011, becoming fifth in the world in terms of expenditure on wine. Wine imports have a very high rate of growth, expanding by 50 percent annually.

For those who consume red or white wine, the strongest preference is for wine from France, although there is a growing demand for wine from Australia too, Ipsos said.

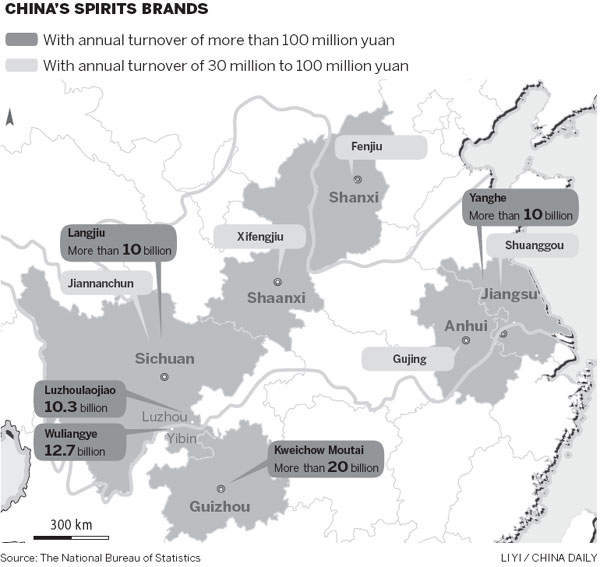

In addition to the boom in wine consumption, Chinese liquors have sold very well in recent years.

Consumption of bottled white spirits in China has increased at a compound annual growth rate of 20 percent over the past five years, according to data from the National Statistics Bureau.

In 2010, the output of the Chinese liquor industry reached 8.91 million tons, with a year-on-year jump of 26 percent. Sales revenue of the industry was 242.16 billion yuan, with a year-on-year growth of 31 percent. In 2011, output of Chinese liquor was more than 10 million tons and sales reached 300 billion yuan.

Moutai producer Kweichow Moutai, based in Southwest China's Guizhou province, generated an estimated 16.8 billion yuan in revenue in 2011, an annual increase of 66 percent. Wuliangye Yibin, based in Yibin, in Southwest China's Sichuan province, reported 20.2 billion yuan in revenue in 2011. This is expected to grow 33.2 percent to 26.9 billion yuan in 2012, according to Bloomberg News.

"The market for fine wine and liquor is growing fast in China. The better the quality and brand, the better the sales. I believe the country's market will be robust for the next five or 10 years as wealth continues to grow," said Lu Fan, a wine trader in Beijing.

Frost & Sullivan listed several reasons for the jump in consumption.

First, overall demand in China has surged alongside the country's fast economic development.

Second, government policies have been encouraging and supportive. In December last year, the Ministry of Commerce issued guidance on strengthening the management and circulation of alcoholic drinks during the 12th Five-Year Plan (2011-15), which further benefited the manufacturers as well as the whole industry.

Third, the tariff on imported spirits was lowered.

After China entered the World Trade Organization in 2001, tariffs on imported wine dropped from about 37.5 percent in 2002. Import tariffs on bottled wine decreased from 65 percent in 2000 to 14 percent now. The lowered tariffs can provide a bigger profit margin for wine companies, which could be used to promote the market's development.

"Hong Kong and the Chinese mainland have been very exciting markets over the past years. The growth of my business here has been extremely strong," said Lu.

In order to develop in the expanding market, major international alcohol companies including Pernod Ricard, Remy Martin and Diageo have set up branches in the world's second-largest economy.

"The rapid development of the Chinese alcoholic drinks market, especially in the past eight years, was mainly pulled by high-end products," said a report from China International Capital Corp.

The Frost & Sullivan report is optimistic about the future of the Chinese spirits industry and mentioned two major drivers of the business.

First, there is growing liquor demand in third- and fourth-tier cities.

As people's living standards improve and the gap between rich and poor narrows, liquor-retailing giants are optimistic about the growth potential in these cities. Some liquor retailing chains have set up stores in these cities using their strong resources, good reputation, strong brand influence and cooperation with local partners.

Second, there are new distribution patterns.

In recent years, distribution channels of alcoholic drinks have developed rapidly. Besides the traditional ways, such as restaurants, supermarkets and cigarette and wine stores, e-commerce has exploded.

"In the future, as competition in the industry gets more and more intensified, it's inevitable that margin growth will slide and there will be overcapacity in the market," said the China International Capital Corp report.

liwoke@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions