|

|

|

A worker on a textile production line in Huaibei, Anhui province. China's industrial production growth dropped to 9.2 percent year-on-year in July, according to the National Bureau of Statistics. [Photo/China Daily] |

The weakest increase in China's industrial production seen in more than three years has given rise to speculation that the country might further ease its monetary policies to stoke economic growth.

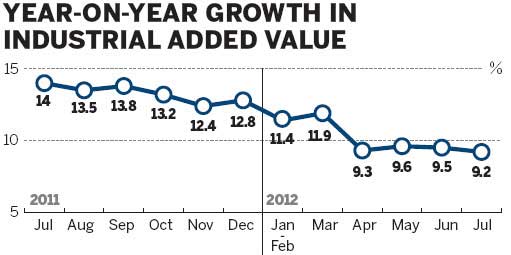

The rate of increase for industrial production slowed to 9.2 percent year-on-year in July from 9.5 percent in the previous month, according to the National Bureau of Statistics.

The July figure came in below the rate of 9.7 percent called for in a previous forecast. Economists said the unexpectedly slow increase could prompt the government to adopt more monetary easing.

Zhang Zhiwei, chief China economist at Nomura Securities Co Ltd in Hong Kong, said the slower growth came at a time when many industries are reducing their inventories.

Such de-stocking is often a sign that the economic cycle is likely to recover, as production increases to replace depleted inventories.

In July, the finished goods inventory sub-index of the manufacturing purchasing managers index decreased to 48 from 53.2 in the previous month.

A score above 50 indicates expansion and one below indicates contraction.

Meanwhile, the monthly producer price index, which measures average changes in the prices manufacturers get for their products, decreased 2.9 percent year-on-year in July, compared with 2.1 percent in June.

The lower producer prices suggested that demand for raw materials has weakened, he said.

He also said the low prices indicate room exists for further monetary easing, and that he expects to see a reduction in the reserve requirement ratio for banks this month.

The possibility of an interest rate cut has also increased, he said, adding that such a change is likely to further inflate any property bubble and hinder banks' ability to make profit.

Apart from further monetary easing, Alistair Thornton, an economist at the information company IHS Global Insight Inc in Beijing, thinks that more investment will be made at the local level.

To stabilize the economy, the government has taken steps to ensure projects can obtain required approvals more quickly, and has introduced a series of policies to encourage private investment.

Local governments, meanwhile, are adopting stimulus plans and banks have been asked to extend more credit.

"The stimulus has yet to feed into the real economy, so growth continues to be slow," Thornton said. "We should not expect to see a sharp recovery."

He said observers have long expected to see an economic rebound, but that isn't likely to happen until the end of the third quarter.

"The short-term cycle of inventory de-stocking might be coming to an end, and government investment will finally help stoke demand for important industrial goods," he said.

If the rate of increase for industrial production remains around 9.2 percent this month and next, China's gross domestic product may rise from 7.4 percent to 7.5 percent in the third quarter, according to Lu Ting, a Hong Kong-based economist with Bank of America Merrill Lynch.

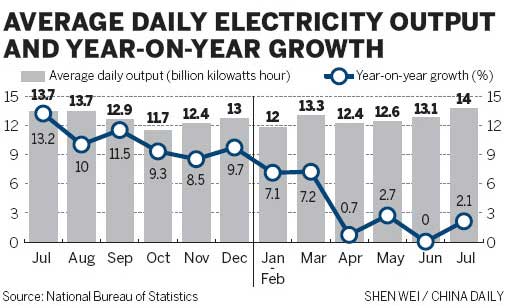

Electricity production, another indicator of economic growth, also shows signs of increasing.

In July, 453.6 billion kilowatt hours of power were generated, up from 393.4 billion kWh in June, the State Electricity Regulatory Commission said on Thursday.

Affected by sluggish economic growth, the amount of electricity produced in China increased by 5.5 percent year-on-year in the first half of the year, a result largely of persistent weakness in the industrial demand for electricity in the past several months.

lanlan@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions