Companies' profit growth is expected to bottom out in the fourth quarter, lifted by stabilizing overseas demand amid a slow recovery of the US economy and the easing of European debt problems, according to the UBS economist Wang.

"The September macro data set seems to suggest some encouraging improvement in demand conditions, both on the domestic and external fronts, although there was likely some seasonal effect in the form of front-loading of activity ahead of the long holiday in early October," said Zhu Haifeng, the chief Chinese economist with JPMorgan Chase Bank NA in Hong Kong.

Since May, the government accelerated policy easing to support the pickup in public investment in areas such as infrastructure, railway, environment protection and clean energy.

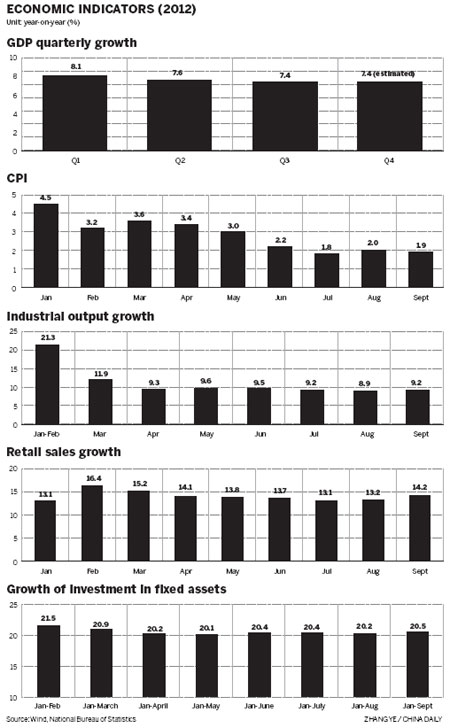

The effects have been seen in September's fixed assets investment data. It increased by 20.5 percent year-on-year in the period from January to September, 0.3 percentage points higher than the figure in the first eight months, the National Bureau of Statistics reported.

"This translated into fixed assets investment growth of 22.2 percent year-on-year in the month of September, the strongest since November 2011," a report from JPMorgan said.

The investment in manufacturing industries increased by 23.5 percent in September since a year earlier, down from 23.9 percent in August. However, the investment growth in railways, highways and roads improved moderately last month, according to the official data.

"Investment, especially in infrastructure construction, is expected to be the main driver to boost growth in the fourth quarter," said Wang of UBS AG.

Consumption, which can be shown from the total retail sales value, increased 14.2 percent year-on-year in September, up from 13.2 percent in August. Sales of furniture rose 31.4 percent and sales of construction materials jumped 26.9 percent, the bureau revealed.

More leading economic indicators support the economists' prediction of a rebound.

For instance, in October, the China Business Sentiment Index, a preliminary indicator released by the Deutsche Borse Group's wholly-owned subsidiary Market News International, slightly rose to 51.52 from 51.35 in September.

It suggested that operating conditions for Chinese companies have changed in a positive way, said Zhang Zhiwei, chief economist in China with Nomura Securities Co.

As the MNI Index is highly correlated with the official PMI index, Zhang predicted the October PMI may rise above the expansion-contraction line of 50. The National Bureau of Statistics plans to release it on Nov 1.

"The Chinese economy is stabilizing and improving moderately as the impact of moderate policy easing begins to show up gradually," he said.

The People's Bank of China, the country's central bank, cut the benchmark interest rate twice this year to lower lending costs to encourage investment since May. It also decreased the reserve requirement ratio twice to inject more liquidity into the market.

Both new loans and monetary supply were boosted in September according to the central bank's records.

"Credit and bond issues have already been relaxed to support economic growth," said a report from Barclays Capital Asia Ltd.

"The broad money supply, or M2 growth, climbed to 14.8 percent, above the central bank's 14 percent full-year target up to September and total social financing is on track to rise to 15 trillion yuan, above the 14 trillion yuan record set in 2010."

A better-than-expected situation is that consumer inflation remained at a relatively lower level amid the easing monetary policy.

The Consumer Price Index, a main gauge of inflation, retreated to 1.9 percent in September from 2 percent in August. It hit a two-year low of 1.8 percent in July, said the statistics bureau.

Economists predicted that inflation may gradually pick up toward the end of the year as food prices may start to rise again, especially the cost of pork. Global commodity prices are likely to rebound as well.

The central bank's deputy governor, Yi Gang, said at the annual meeting of the International Monetary Fund and the World Bank on Oct 13 that "this year's inflation rate is fine". However, medium-term inflation pressure may remain significant.

Zhu from JPMorgan forecast that the CPI is likely to remain below 3 percent by the year's end, while the full-year reading is expected to be 2.7 percent.

"In the near term, with the economy's growth momentum improving gradually and with inflation picking up later this year, the likelihood of further interest rate cuts in the rest of 2012 is diminishing in our view," he said.

In the last quarter, the central bank may cut the reserve requirement ratio again by 50 basis points, Zhu added.

Based on the better outlook of statistics in recent weeks and because the impact of moderate policy easing measures will continue to show up in the real economy, economists are confident about China achieving its whole-year GDP growth target of 7.5 percent.

The growth rate in the fourth quarter may stabilize at 7.4 percent year-on-year, which can support a 7.6 percent expansion pace across the whole year. It is forecast to rise steadily from the first quarter next year and achieve 8 percent growth in 2013, according to the JPMorgan economist.

"It should be noted that China's potential growth has likely come down to lower than 8 percent. This is likely behind the government's higher tolerance for slower growth in 2012 and also its small appetite for over-stimulating the economy above its potential," said Huang Yiping, a Chinese economist with Barclays Capital.

chenjia1@chinadaily.com.cn

Electric car industry in the slow lane

Electric car industry in the slow lane Gas license auctions get mixed reviews

Gas license auctions get mixed reviews Market flat, Japan-brand sales plummet

Market flat, Japan-brand sales plummet China initiates new exporter review for Nissan

China initiates new exporter review for Nissan